by Smart Choice Express Markets team

2023 was a difficult year for many in the insurance industry. The hard insurance market continued with high premiums, strict underwriting guidelines, and reduced coverage availability.

For an independent insurance network like Smart Choice, this means less appointment availability from standard insurance carriers. Those lucky enough to have appointments deal with the consistent frustration of declined submissions.

Unfortunately, the market projects more of the same constraints for 2024.

Yet despite the ongoing market constrictions, Smart Choice as a whole saw significant growth in 2023 and projects the same for 2024.

So, what gives?

Excess & surplus (E&S) lines have given independent insurance agents the capability to write business that has fallen out of standard lines.

The numbers tell the story.

According to S&P Global, excess and surplus premiums increased for a fourth straight year in 2022, rising 20% to $75 billion from $69 billion in 2021. The trend only grew stronger in 2023.

Per data from the Wholesale & Specialty Insurance Association (WSIA), 2023 premiums showed a 14.6% increase from 2022. Incredibly, the data provided was from only 15 states – totaling $73 billion. This data includes some notable heavy hitters when it comes to hard-to-place states, with both California and Florida putting up large numbers. Nonetheless, the numbers show one indisputable fact – as the hard market has progressed, E&S has stepped up to the plate.

What does this mean for Smart Choice agents?

As the hard market began to throw agents a curve ball, Smart Choice took action by advancing our Specialty Lines division, Express Markets.

With the expansion of Express Markets, Smart Choice was prepared for the hard market constraints, and the data bears this out. Express Markets finished 2023 with nearly $600 million in carrier partner premium. A figure that was just around $300 million in 2020 has grown exponentially with the impact of the hard market.

This growth was not spontaneous; in fact, it was anticipated. The groundwork for growth was meticulously laid out over the course of the past five years, with the expectation that agency partners would need solutions for their clients when business began to fall out of the standard market.

Over the last several years, Express Markets has partnered with over 40 carriers in a wide range of market segments, from non-standard auto to artisan contractors. The numbers and data only show one side of the story.

Just as important are testimonials and success stories from Smart Choice’s agency partners.

Breaking Down Express Markets Success

Navigating a hard market as an independent insurance agent is a difficult task. A safe bet for finding success in a hard market is diversifying your carrier markets and adding additional distribution points to your agency.

Smart Choice Express Markets has been able to help agents find sustained success within the hard market by putting together a well-diversified carrier partner base to which Smart Choice agents have easy access.

5 key market segments

The five sub verticals that make up Express Markets include the following:

- Wholesale markets

- Property & home

- Non-standard auto

- Artisan contractors

- Specialty / niche

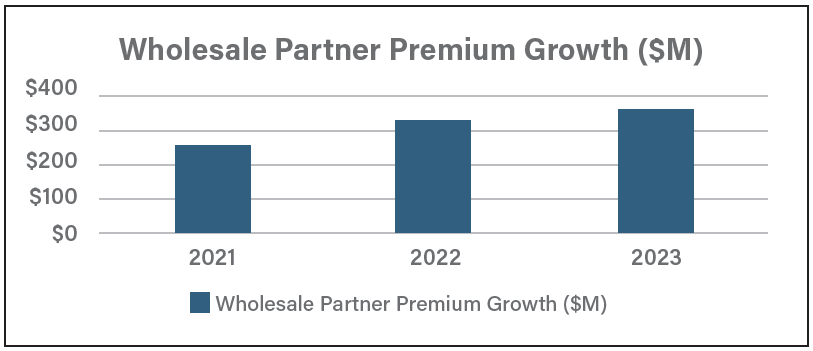

Hard market constraints have pushed E&S wholesalers such as Burns & Wilcox, CRC Group, and RPS to the forefront of the insurance industry. The chart below provides a look at just how much premium Smart Choice agents have written with Express Markets wholesale partners in the last three years.

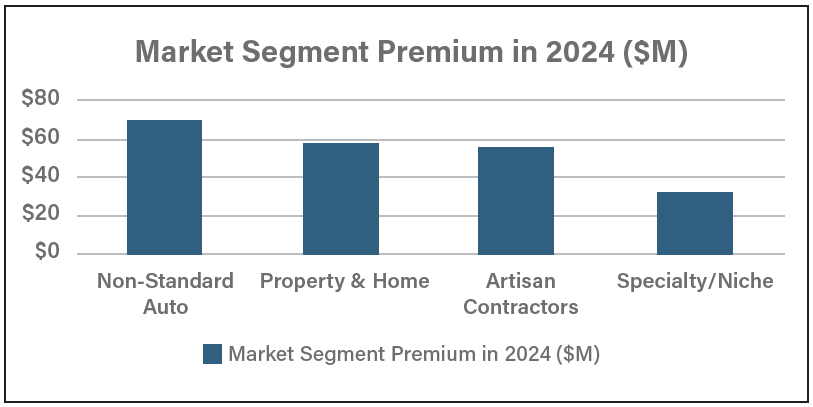

Outside of Express Markets’ wholesale partners, the chart below shows the range of premium growth from other key market segments:

To our agency and carrier partners, the success of Express Markets would not be achievable without your hard work and dedication. For that, we thank you greatly & appreciate your partnership.

~ Your Express Markets team